We may have reached “Peak FOMO” this month in Denver Real Estate. If you haven’t heard the term before, FOMO is the Fear of Missing Out.

FOMO is a very real thing, it’s a byproduct of the human psyche and the human condition to want to fit in, to want to feel successful, to want to have as much or more than the next person. What I did not realize is that this term is a relatively new term, according to internet searching, FOMO was coined around 2004 and can be defined as:

the feeling or perception that others are having more fun, living better lives, or experiencing better things than you are. It involves a deep sense of envy and affects self-esteem. It is often exacerbated by social media sites like Instagram and Facebook.

It makes complete sense that FOMO was coined around 2004, around the time facebook and instagram came out, and also that it has gained more and more steam from then until now as social media has quickly gone from a cool way to connect with people to the 800 LB Gorilla that has overtaken the lives (social and otherwise) of most adults, in particular younger adults (although Boomers seem to use Facebook in the greatest percentage numbers).

To be clear, FOMO can be applied to many things in life, but it certainly be applied to Real Estate and other investments like stocks, and may partly serve to explain the huge run up in prices for these assets.

FOMO + Real Estate

Here’s an example from this past weekend, January 21-23, 2022. This house was listed at $675,000, very much in line with comps. A small bungalow on the fringe of a good neighborhood. In the past few weeks since the beginning of the year, mortgage rates have gone up on average about 75 basis points (.75%), or have gone up about 25% in just a few weeks. Normally that combined with the fact that it’s January and the middle of the winter would combine to calm the market.

Remember the term, “keeping up with the Jones’?” That predates FOMO and social media. You neighbor or someone in your cohort, someone at your church or school, got a new car, upgraded their house, joined the country club, remodeled their kitchen. You see that and subconsciously think, they have better “x” than I do, I need to do the same thing. It’s literally one of the most base human instincts.

With social media, instagram in particular, you are barraged with incessant reminders of your friends checking off milestones. If you are in a younger cohort, say millennial, these milestones including career things, marriage, and home purchase, and now starting families. Homes and families usually go pretty hand-in-hand.

It can be especially hard seeing your friends humbly brag on the gram about their new home purchase and new dog, especially if maybe they were lucky to have bought a couple years ago and their houses are worth more now. It really makes a person feel like they are getting behind, they are missing out.

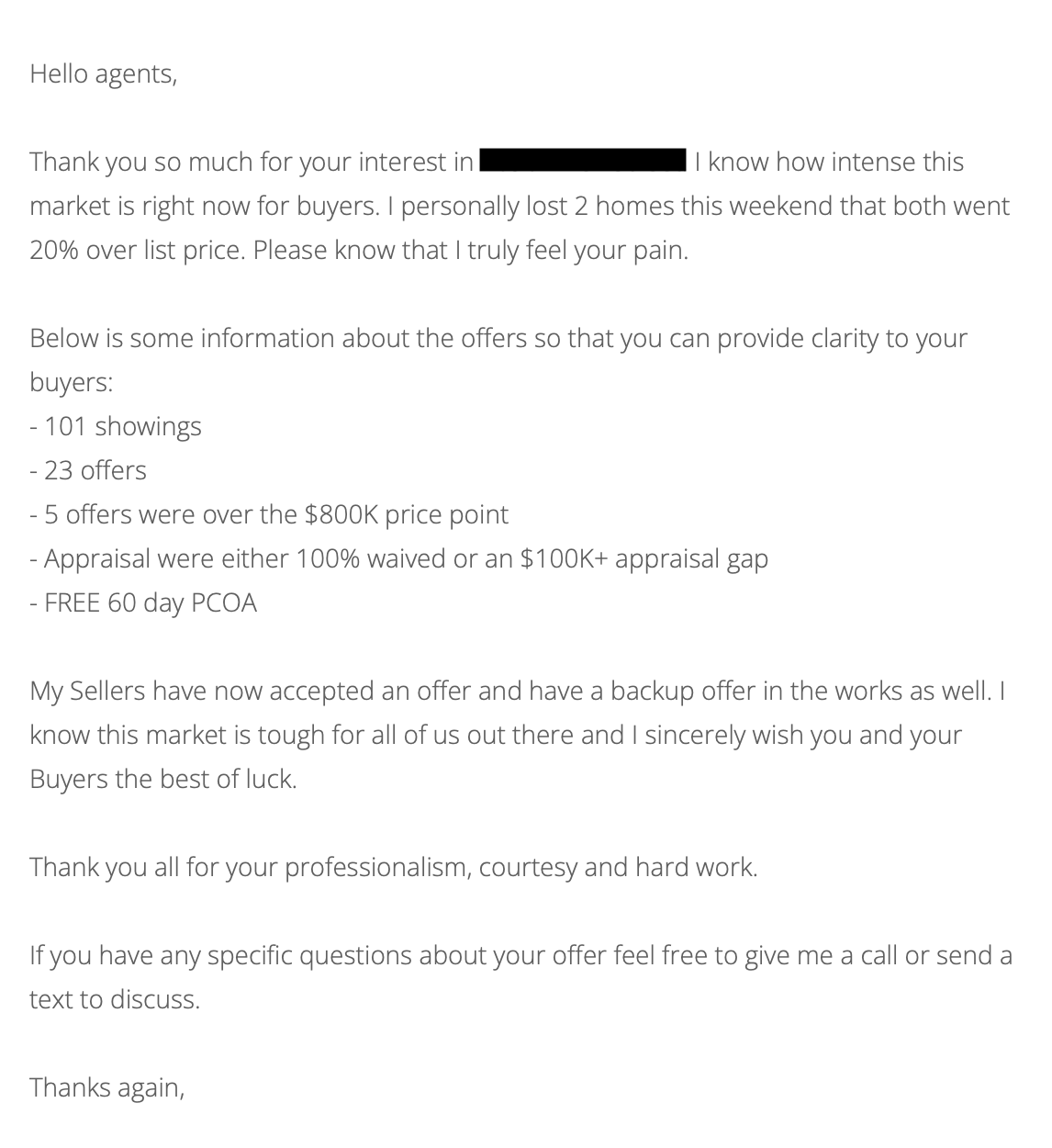

You may have heard of wild bidding wars for houses. I’ve been involved in numerous home sales and home purchases just in the past couple years where the final price has been $100,000+ over the list price, or more than 10% above the list price, with 12+ offers. A normal sale may go 3-5% over ($25,000-50,000) with merely 6-8 offers. In order for a price to get that high, the market value range for the property gets thrown out the window. Brokers will set the list price based on prior comps. So, if a house sells for $100,000 over the list price, in essence that means that you just paid $100,000 more than the most recent sales right around there. Now, that is often the only way to secure that house, meaning that is what the buyer has to do to win the bidding war.

This is due to scarcity of inventory, but also FOMO. The psychology of FOMO as it related to Real Estate is irrational. The price and valuation become secondary to winning, to not missing out.

This is a major reason why many buyers suffer from buyer’s remorse.

Patience is a Virtue

How to not become a victim to FOMO? People that purchase at peak FOMO will 100% be underwater on their houses once the reversion occurs. This is a certainty. It goes back to the immutable laws of markets. It’s kind of like gravity- what goes up, must come down.

It is absolutely still possible to purchase a home in this market, while still keeping an eye on value, while staying rational. You might not get your dream house, but you also might not be setting yourself up for a bad financial purchase either. Also, it’s ok to tell yourself that it’s ok if you don’t buy for a few more years. It’s easy to get caught up in FOMO, but if the property matters at all to you as an investment, then it’s important to keep an eye on the fundamentals and keep your wits about you.

Leave a Reply