June 16, 2023

There’s a phenomenon known as “Golden Handcuffs” being mentioned for a large part of the reason why inventory levels in Denver are very very low.

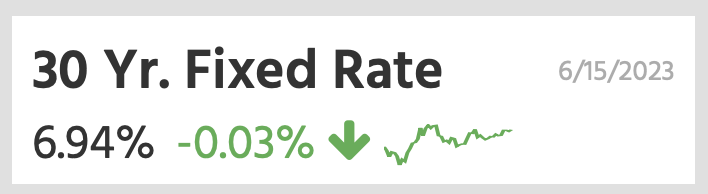

The concept is that due to people having low mortgage rates, they will not sell. This is partly true, but there is more nuance to the issue at hand. The fact of the matter is that the vast majority of people with mortgages (98% by some estimates) have “below market” mortgage rates. The market rate today for a 30 year fixed rate mortgage is around 7%.

Thus, virtually everyone with a mortgage has a rate lower than 7%.

More specifically, and more importantly, 62% of people have mortgages below 4% and 23.5% of people have mortgages below 3% (source: National Mortgage Professional)

This is a real problem for mobility, and housing liquidity, but it’s not as simple as merely looking at the mortgage rates. To illustrate my point, the average mortgage rate (30 year fixed rate) over the past ~50 years, from 1971-2023 was 7.74%, so the current rate is still below the long term historical trend line.

Mortgage rates of 6% or 7% on their face are not the issue, but they are when combined with the highly inflated house prices, along with all the other personal debt loads that the average person carries. Sellers are not hanging onto their rate per se; they are hanging onto their payment, and to the net cost of ownership. A sale and new purchase would increase a person’s payment and cost of ownership significantly (assuming same loan to value i.e. 20% down/20% down) so they’re going to stay put, but not because they have to.

Remember: Buyers buy a payment. Sellers sell the price.

These figures are meaningless without context, though.

Prices are simply too high now for normal market liquidity. The market is largely devoid of average buyers and sellers. It’s more being driven by buyers and sellers at the margins. There’s will always be a certain volume of transactions in any market, so it’s not unexpected that transactional volume will continue somewhat, although grinding down. You may have heard of the 3 D’s: Death, Divorce, Distress. These occur in every market and even in the worst of markets, some transactions will occur.

Owners Are Not Handcuffed

Anyone who has one of these lower rates (sub 4%) would have bought Spring 2022 or earlier, and in many cases, bought well prior to 2022, or refinanced during this time period. Mortgages rates were in the 3%’s for much of the decade 2012-2022.

All of these owners have some equity in their home, or in many cases, huge amounts of equity in their homes, meaning they could easily sell at any given moment and make a net profit. Again, in a lot of cases, this would be a large profit. Thus, by definition they are not handcuffed at all. Upon a sale, they could purchase another house but more smartly could rent in the short term. Apples to apples, in Denver currently, renting is significantly cheaper than buying right now.

Being handcuffed implies being “underwater” on your house, having negative equity, or being in a precarious position where you can’t sell, and either cannot rent, or can only rent at a rate that is too much a loss to sustain. This type of underwater situation leads to foreclosures.

Locked-In Effect

A much better term which is also used is “locked in.” These owners are locked into a great rate, and this mortgage is an asset to them. They are not stuck in a situation; more accurately, you have an asset that you want to keep. You have something that will be more valuable in the future. When a person is “locked-in” they have their eye on the ball; they are firm and resolute. They don’t need to force the equity out now because they have a good house at a manageable payment. This is what the housing market is supposed to be. It is supposed to be slow and boring, and the house basically appreciates minimally at the rate of inflation. You buy a house because you can afford it and it’s a good place for you to live for a good, long time.

The Bank is the One Who Is Handcuffed

It is the lender or lien holder who is handcuffed. The lien holders would love for people to sell their house, repay their note, so that the lender can deploy that capital at a new, higher return. However, the lender cannot do this. The vast majority of mortgages are fixed, or set for the 30 year duration, and they cannot be called due under any circumstance besides non-payment.

Lower Prices Will UnFreeze the Market

We need lower prices, not lower rates, to unfreeze the market. Two things will occur as prices trend lower. One of that sellers who are on the fence will be motivated to liquidate as they see prices continue to move down. There will be sellers, and some will be second home owners, airbnb owners, buy and hold investors, who will try to grab a seat as the music slows down.

The other action that will occur as the prices come down, assuming mortgage rates stay the same, or perhaps trend a bit lower into the 5-6% range, is that lower prices will make the calculation for these “locked-in” sellers to pursue a different house and sell their current house.

Mortgage Rates May Not Go Back Down Substantially

If you look at interest rate history going back decades or centuries, these rate cycles usually last for decades. It’s like a pendulum swinging from one direction to the other. If this cycle is in fact just starting, then we could very well be in for many years or decades of interest rates at this level or higher. Asset prices like Real Estate, house prices, will need to adjust, and that is the market forces in action.

Some people who are locked-in will hold “to duration” for 15,20,30 years etc. Many will not want to, or will not be able to.

It doesn’t matter if you are a buyer or a seller, it’s important to understand how the current and future mortgage rate environment affects, and will affect, your investment and ways you can maximize your investment, or mitigate your risk.

This part of the blog post highlights how mortgage lenders face limitations in deploying capital due to the long-term nature of most mortgages. It’s a reminder that while homeowners benefit from stable payments, lenders miss out on the opportunity to invest in higher-return ventures, as mortgages are typically fixed for the long haul. This underscores the need for potential reforms to strike a better balance between borrower stability and lender flexibility.