There’s a term in residential real estate to describe Buyers who are ready to go: Ready, Willing, and Able. These people have their ducks in a row, are qualified financially (both literally qualified with lender, and figuratively qualified, meaning they have assets and employment to support a purchase without having to do anything else). Their intention is to purchase a property in the short term, i.e. within the next 90 days typically, and in a normal market, this usually results in these buyers completing a purchase quickly.

Right now, in Real Estate in the US, but moreso in Colorado and Denver more specifically, my area of practice and expertise, there are very few ready, willing, and able buyers out there.

Ready, Willing, Not Able

What we have instead are many people who would love to buy a property, who would love to own a home vs. renting. They “desire” to buy and own a home. However, their financial profiles really do not allow them to feasibly buy a property at today’s prices. This is a combination of incomes and debt loads, mortgage rates, down payments, and current prices. These factors all combine to make payments on purchases too high for most people who desire to buy a property.

A similar thing is even happening in new car sales, despite it being much easier to qualify for a car loan. Between the cost of new cars, and the financing rates available, most people who desire a new car, simply will not due to the numbers just not making sense for them.

There is a huge difference between “Demand” and “Desire.”

The Demand side of the curve has fallen off a cliff. This is not only evident to any intelligent, full-time, Real Estate agent (many are not), but any loan officer, many of whom have seen their business and lead pipelines evaporate. Now, there are still a lot of fanboys and pumpers out there trying to hold up the narrative that the demand is still robust, bidding wars, etc. etc. Those are just little pieces of cherry-picked anecdotes.

The Proof is in the Data

Mortgage applications are the best indicator of present and future demand.

Mortgage applications just plummeted to the lowest level since 1995. 📉

Down 50% from pandemic highs.

Not good. Sellers will need to reduce the price to bring buyers back in. pic.twitter.com/8ZrZycyx8C

— Nick Gerli (@nickgerli1) August 25, 2023

Mortgages Applications are real time data. They are also leading indicators of what’s here now and to come.

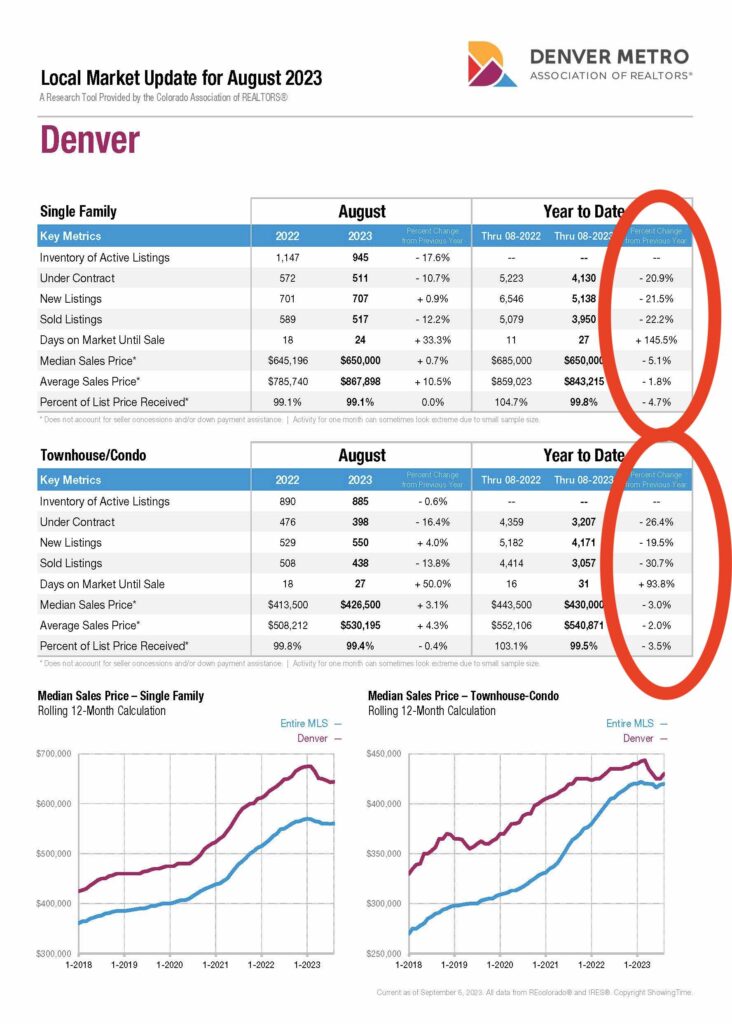

Sold Data from the last 30-90 days tells the story of the past, it’s a trailing indicator, and it moves slow. The market is grinding down more and more every month. Let’s take a look at the latest Denver data sheet from August 2023:

Despite inventory being very low, contracts (pending) and Closings are down significantly year over year (and August last year 2022 was a very bad year so we’re down a further 20%+ since then).

Able, but Not Ready or Willing

The other segment of the demand side is people who are entirely able to buy, but are wary to not buy in a market such as this. People who have great employment and assets, most likely they already own a home, or they have in the past, they’ve probably been through market cycles, they’ve probably got a financial portfolio that they are trying to preserve or grow. These are more sophisticated buyers. These are not the marginal buyers. These buyers are unlikely to enter the market in its current condition. Prices or rates, or both, would need to improve significantly for these types of buyers to wade into the action.

Conclusion

The demand destruction is real, and has been relatively swift (12-18 months). With Mortgages Rates as of today (September 20, 2023) on an average 30 year fixed at 7.3% and seemingly poised to go higher in step with the 10 year yield, the probability is that the demand will further erode, prices will continue their grind down at least into Q4 and year end.

Insightful analysis of the Denver real estate market, highlighting the shift from “Ready, Willing, and Able” buyers to those who “Desire” to own a home but face financial constraints. The distinction between demand and desire is crucial, evident in the current mortgage application trends. As the market evolves, considering strategies like selling your house fast in Denver becomes relevant, emphasizing the importance of staying informed and adaptable.